Sandy West’s Ossabaw Champions recognizes individuals who have chosen to support our work by including The Ossabaw Island Foundation (TOIF) in their estate plans. Planned gifts, including bequests, help facilitate ecology, archaeology, historic preservation, and cultural study today and well into the future.

Joining Sandy West’s Ossabaw Champions is easy – include TOIF as a beneficiary in your will, retirement plan, life insurance, trusts, or other estate planning vehicles. Sandy West’s Ossabaw Champion members receive special recognition and invitations to donor events and programs.

Important Donation Information

Legal name: The Ossabaw Island Foundation, Inc. Address: 13040 Abercorn Street, Suite 20 Savannah, GA 31419 Tax ID#: 58-1397054 Sandy West's Ossabaw Champion Form

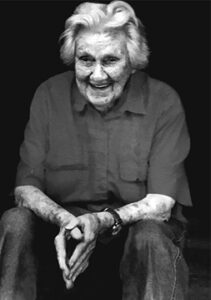

Eleanor “Sandy” Torrey West dedicated herself to preserving Ossabaw Island for future generations. She was inspired by Archimedes, a famous mathematician and inventor in ancient Greece. “I want this island to be a refuge outside the ‘real’ world, where creative people can stand and find ‘a lever to move the earth,’ ” she said, quoting Archimedes. “All I wanted to do is give people a place that had no demands on them and where they would be with other interesting people in different fields..… I cared about what the island did to them.”

The material provided is not offered as legal or tax advice. Examples of prospective benefits may not apply to your situation at the time of your gift. We encourage our donors to seek the advice of a tax advisor, attorney, and/ or financial planner.

Stock Gift

Stock gifts are an effective way to support the Ossabaw Island Foundation, Inc. (TOIF).

- DCT#: 0226

- Brokerage Firm: Truist Investment Services LLC

- Credit Account: Ossabaw Island Foundation, Inc.

- Credit Account Number: G5R-064718

- Contact Person: Deborah Spears

- Contact Number: 843-301-3531

- Contact Email: Deborah.Spears@truist.com

- TOIF Gift Notification: elizabeth@ossabawisland.org or 912-344-3900

Bequests

Gifts made through a Will

A common form of planned giving is a charitable bequest, in which you bequest a specific sum, property percentage of your estate, or portion of your estate to the Ossabaw Foundation, Inc.

Please consider a bequest for the Ossabaw Island Foundation to leave a legacy for Georgia’s third-largest barrier island. Every estate plan is different, so please share this information with your estate planner to determine which works best for you.

Retirement Account Gift

Retirement accounts like IRAs, Keoghs, and 401(k) plans are taxed as income to your heirs and may be subject to estate tax. Alternatively, you can name the Ossabaw Island Foundation, Inc. as the beneficiary of your retirement funds and make other estate provisions for loved ones. That way, the entire designated amount passes to the Ossabaw Island Foundation tax-free, and your gift is fully deductible for estate tax purposes.

Life Insurance Gift

Do you have a life insurance policy you no longer need?

You can name the Ossabaw Island Foundation, Inc. as the beneficiary of your existing life insurance policy or transfer the ownership to the Ossabaw Island Foundation.

Charitable Remainder Trust

- Do you have valuable assets, such as appreciated stocks or a second home, that are “tied up” and not producing income?

- Would you like additional income for yourself, your spouse, a parent, or a child?

- Would you like to leave a generous gift to The Ossabaw Island Foundation, Inc.?

If your answer is “yes” to all of the above, then a Charitable Remainder Trust may be your perfect choice.